.

.

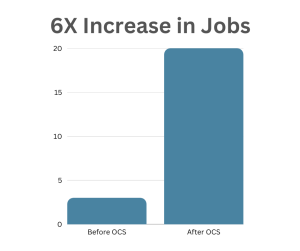

Apex Restoration sought to expand their business by serving a greater number of customers, but recognized that they required assistance in negotiating their claims with insurance adjusters. So they formed a partnership with One Claim Solution (OCS), and as a result, their company experienced a remarkable sixfold growth.

“We started out as a tiny company doing three to five jobs a month, then 10 jobs a month, and then 15 to 20 jobs a month!” said Nate Birch, Owner of Apex Restoration.

Birch relocated from bustling Chicago to the serene city of Boise, with a determined vision to establish a new venture. Leveraging his network in the restoration industry, he collaborated with like-minded individuals and founded Apex Restoration on October 15, 2020, amidst the peak of the COVID-19 pandemic.

“Scratching the entrepreneurial edge was the main thing. But now it’s become a full, life-changing career,” Birch said.

Prior to working with OCS, Birch’s partner was responsible for managing all invoice billing, while Birch concentrated on business development and leading the field. As their business grew, they realized the need to outsource insurance billing, enabling them to focus on other areas of growth. So they formed a partnership with OCS.

According to Birch, the onboarding process with OCS was easy and smooth, largely because Apex Restoration was so small starting out.

“The onboarding experience is unique for everyone,” Birch said. “I can’t speak for what the experience would be like for a bigger company. But having worked with OCS now for a couple of years, I would have zero insecurity about going through an onboarding process with them just because of the sheer organization that they provide.”

“If you looked at our growth on a month by month basis and looked at the sheer volume of work that we’re doing, there’s no way we would be able to continue to take on the increased workload,” Birch said. “Just the other day, we hit yet another record as a company in terms of just sheer volume of jobs that we’re doing.”

Birch said if he had to rely on an in house billing staff, it wouldn’t be as efficient and would require additional time and training.

“I wouldn’t be able to continue to put the effort and energy that I’ve been putting into sales. But because we have OCS, it’s allowed us to have unlimited growth,” Birch said. “I don’t have to take my foot off the gas. I can continue to sell and get support from a billing perspective because of OCS.”

According to Birch, collaborating with OCS has been an entirely positive experience. He has complete confidence in their ability to comprehend the requirements for setting up efficient systems, methods, guidelines, and rules that ensure the smooth functioning of Apex’s insurance billing process.

“I have just tremendous respect for OCS and the personalized support they provide us,” Birch said. “I see the energy and effort that goes into finding the best billing solutions possible.”

Birch is also grateful for the relieved pressure on his team from having to communicate directly with adjusters.

“Having a response and a rebuttal to every single one of those reasons why they don’t want to pay our bill would just be exhausting,” Birch said. “I know for a fact we wouldn’t be where we’re at as a company without having OCS take the other half of our business off of our plate.”