Change in the property insurance industry almost always has an impact on the restoration industry, so it’s important for restoration contractors to stay up-to-date on insurance coverage trends. At One Claim Solution, we interact with restorers and insurance providers every day. Here are some of the recent carrier coverage changes we’ve witnessed and advice from OCS Co-Founder Josh Ehmke on how restoration contractors can adapt their customer communication approach in response to these changes.

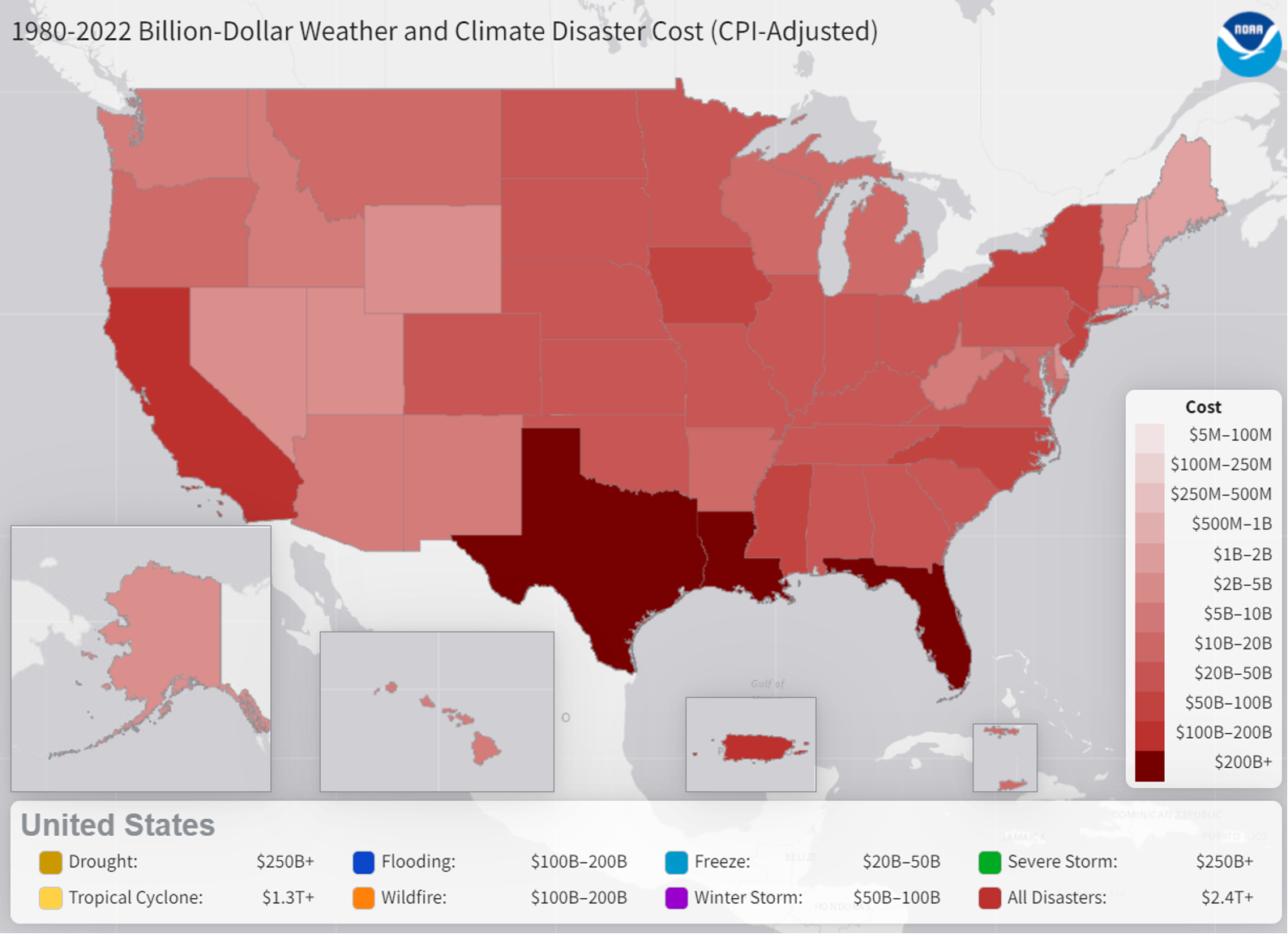

Weather and climate catastrophes are occurring more frequently. In response to the increased costs of disasters, many insurers are dropping customers or choosing to no longer offer new policies in high-risk areas and states.

Unsurprisingly, the states that are hit by the most expensive weather and climate disasters, like Florida, Louisiana, Texas, and California, are the ones being affected by these coverage trends the most. Major carriers like Allstate and State Farm no longeroffer new policies in California. Farmers dropped more than a quarter of their Florida homeowner insurance customers. Policies in high-risk states are also becoming increasingly expensive.

Source: NOAA

Another trend in insurance coverage that OCS is seeing is carriers selling policies with lower limits and more exclusions. For example, Josh has seen insurers sell policies with $10,000 limits for water damage claims. “Good luck getting your house put back together for that,” he comments.

“I do not believe that homeowners know what they’re signing when they sign up with their insurance company 99% of the time,” Josh explains. Then when they go to file a claim, they learn that they don’t have coverage for something that they thought they did.

It’s frustrating as a restoration contractor to get to witness first-hand how policy changes like these impact customers. While you may not be able to control policy changes, you can control how you respond to them. Here are some tips for how to adapt your customer interactions with these changes in mind:

Whether you want it to or not, your customer’s insurance policy can impact how you approach your restoration work. Early on in the restoration process, have your customer call their provider to learn about their policy’s limits and exclusions. Coach them before the call about important questions for them to ask. “It’s really just an educational process with the homeowner to make sure they’re asking the right types of questions from their adjuster on the front end,” Josh says.

In a world where customers have policies with lower limits and more exclusions, more of the cost responsibility falls to the customer. Because of this, it’s more important than ever to be upfront with your customers about the lien process so that it doesn’t come as a surprise. For more advice on how to explain lien and pre-lien, read our recent blog.

Be candid with your customers about the different courses of action you can take to mitigate a disaster. “You want your customers to be aware of and knowledgeable about the processes lying before them so that they can make an educated decision,” Josh explains. If their insurance coverage is limited, they may want less extensive restoration work to save costs. It’s important to be honest about the risks with them while also understanding where they are coming from.

If you’re a restoration contractor who wants more insight into the restoration industry and advice on how to communicate with your customers, subscribe to the OCS newsletter.